Onboarding new hires typically lasts months should be considered a long-term effort. Often confused with orientation, which includes formal training and human resources related tasks, onboarding is key to employee retention, happiness, and productivity. Think of orientation as a shorter first-step in onboarding new hires.

Onboarding Should Begin Before a New Hire’s First Day

Banking is well known for being both a competitive industry and an industry with one of the worst retention rates sitting at 17.4% turnover annually. This is largely due to a poor onboarding experience which includes misrepresenting a job, a poor culture fit, inadequacy in skills matching, and even a bad first impression.

During initial interviewing, bank hiring managers should be prepared to answer any questions an interviewee might have, as well as represent the bank’s interest in assuring there is a mutually beneficial fit between the bank and candidate.

Key questions to align expectations include:

- Have the job role and functions been accurately represented?

- Does the interviewee have a good feel of company culture and fit?

- Are there any critical questions that can be answered at this time?

Once a new hire is deemed a good fit and signs off on an employment contract, the real onboarding process should start. Communication is one aspect that should be at the core and will be a driving factor in a new hire’s first impression.

Key questions to build a good first impression include:

- Does the new hire know a detailed timeline of what to expect next?

- Can most or all documentation be streamlined prior to their first day?

- Is the new hire excited and feel valued, reassuring his/her decision?

A New Hire’s First Day and Beyond

In an ideal onboarding situation, new hires will feel appreciated and be given an experience that is dynamic, transparent, and modernized. The consequences of providing a stale experience are quite grim. A report by SHRM found that US companies lose 25% of new hires within their first year, often due to a poor onboarding experience.

Banks should shoot for a few key objectives when onboarding new hires:

- Leave new hires informed, excited, and well-equipped for success

- Eliminate mundane tasks that can weigh down the process

- Incorporate executive input when structuring a program

- Use technology to train and provide flexible learning

- Encourage a two-way feedback loop at the end of each milestone

The objectives above provide a basic structured approach to onboarding. In banking and financial services, there are often formal training programs that last anywhere from two weeks to a month. These include technical and job-related training such as financial modeling, all the way through company specific training including the bank’s mission and future roadmap.

For competitive roles such as investment banking, training programs have been standardized to include proper financial securities licensing, such as the infamous Series 63, and all necessary compliance training. These more formal training provide structure but can still be modernized utilizing mobile technology.

The Importance of Ongoing Training and Education

A 2012 study found that it takes employees up to 8 months to reach full productivity within a new company. Within the first 6 months alone, it is reported that up to 33% of new hires begin looking for a new job. This drives the point that banks should continue to provide onboarding support and training. New hires want to feel supported and equipped with the best tools and knowledge.

JP Morgan Chase recently launched two new global initiatives aimed at offering demand-driven skills training for both adults and youth. New Skills at Work, is a five-year $250 million initiative aimed at training a more well-rounded workforce while helping fill the employment gap of highly-skilled workers that are in demand. 50% of global CEOs are concerned that a key skills gap could limit growth prospects.

Is Ongoing Training Necessary for Successfully Onboarding New Hires?

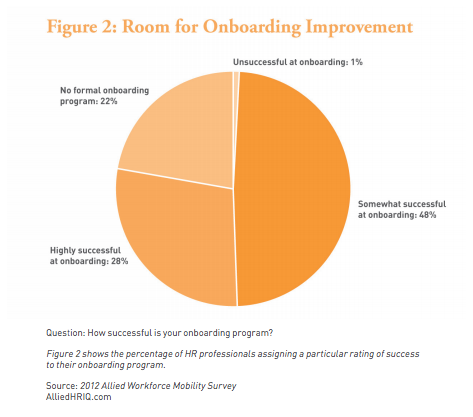

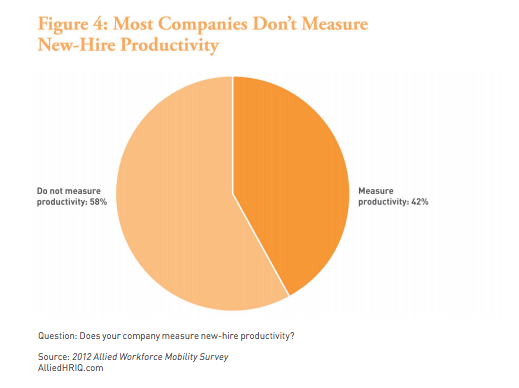

Statistics show that even successful onboarding programs face challenges. Knowledge retention, motivation, and engagement are examples of the challenges banks have. In general, only 16% of training information is retained after three months. In the US and UK, companies spend $37 billion per year to keep unproductive employees who do not understand their jobs.

The various implications of a poor onboarding experience all result in a negatively impacted bottom-line for banks. The cost of replacing a senior level employee is roughly 2X the employee’s annual salary. For a mid-level employee this figure it still roughly 75% of the employee’s annual salary:

Taking a median salary reporting by Salary.com, a Financial Executive salary is $239,532. This means by losing this executive a bank will incur a loss of a bit shy of $500,000. This includes costs associated with recruiting, training, and onboarding a replacement. Factor in an annual turnover rate of 17.4% in financial services and the bigger picture becomes clear – banks can’t afford to lose employees due to factors such as an unstructured onboarding program.

Mobile Technology as the Catalyst for Onboarding

Mobile technology, such as training applications and onboarding support applications, have been proven to provide procedures and methods that increase knowledge retention and drive engagement. As banks turn more and more to technology, mobile application integration will become more common and help provide specific benefits, such as:

- Training modernization and the elimination of traditional methods

- Flexibility and adaptable learning solutions tailored to learning styles

- Scalable enterprise programs that lead to cost savings

- A focus on feedback, tracking, and growth through digital analytics

- Customizable learning objectives and skill matching

Depending on a bank’s onboarding structure and goals, mobile technology should be incorporated, especially as more and more customer facing banking solutions are becoming digital. Digital applications help drive efficiency and productivity.

How are financial institutions onboarding employees in a time of increasingly complex compliance and regulation? What's technology's impact and how are companies already using it?

How are financial institutions onboarding employees in a time of increasingly complex compliance and regulation? What's technology's impact and how are companies already using it?

- State of the industry's technology

- Banks & mobile apps: can they benefit?

- Onboarding and innovation in banking

- Onboarding implementations

- 10 facts on retention, training, and talent sourcing

- Exclusive TLDR summary