Banks looking to compete in today’s environment have no choice but to grow and adapt into the digital economy. These transitions are often monumental as banks shift to mobile and online banking, lending, payment processing, and person-to-person (P2P) services. Banks are adopting these banking technology trends to drive efficiency, convenience, and security.

During this shift, banks need to abide by regulatory safeguards, keep their customers happy, and maintain security and trust. This delicate balance has created a marketplace for both internal and external technological solutions.

These include robots, mobile payments, blockchain, and more. Here are a few banking technology trends that are currently taking off and expected to grow in 2017:

1. Artificial Intelligence Will Grow in Importance

Artificial intelligence is expected to only get more prominent in the future as technology and cognitive information systems advance. Accenture estimates that within 2015-2018 there will be a total of $19.6 billion in professional services robots sold.

For banking specifically, the adoption of artificial intelligence brings a host of new benefits, not only cost savings through greater efficiency. In fact, 86% of bank executives agree that the widespread use of AI provides for a competitive advantage beyond cost. Those same executives said they plan on using machine learning to drive automation in customer service and IT.

It is important to note that the use of artificial intelligence does not mean banks will need to cut staff – at least in the near future. There will be a learning curve and integration necessary to reap the full benefits of machine learning and automation. Banks should seek to create a culture that is symbiotic and accepting of advanced machines and banking technology.

2. Mobile Technology and Applications Will Replace Old Processes

At the very minimum, most banks offer a mobile banking app that can process transactions and replace traditional paper balances. A 2016 report by BBA found that in 2015, UK banks processed 347 million payments via mobile – a 54% increase from the year before.

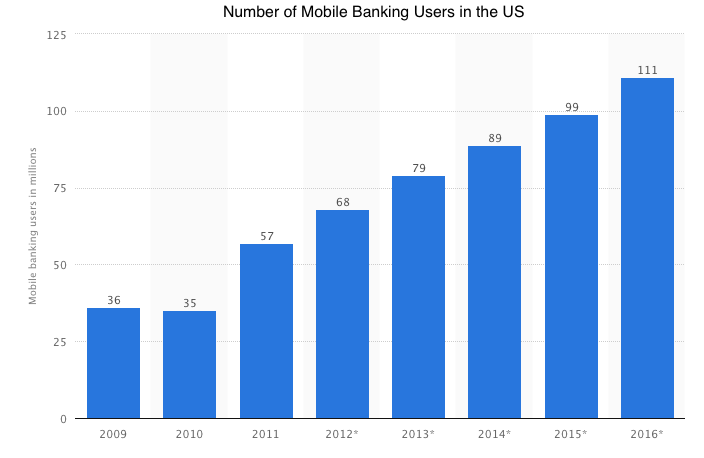

In the US, there are over 111 million mobile banking users. This means that one in three US citizens currently use mobile banking. The popularity of mobile first solutions is only on the rise as security improves and people feel safer using mobile banking features.

Figure 1 Source: Statista

Additionally, banks are looking externally at mobile application developers to streamline their training, onboarding, and compliance efforts. Mobile applications offer customized and scalable solutions that are modern, cost-effective, and could be the future of learning and training.

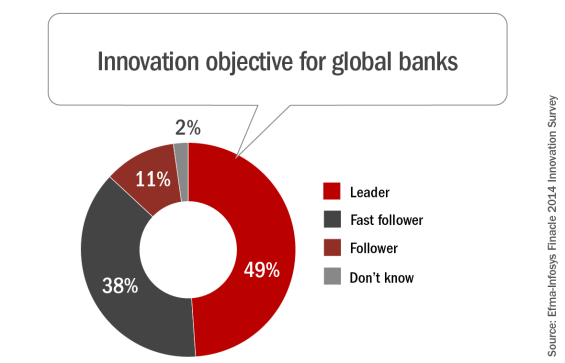

3. Banks Will Focus and Invest Heavily in Corporate Innovation

As banking becomes more digitalized, banks are recruiting and building tech teams, and in some cases full companies, under their global operations. To compete with leading tech giants, banks are now trying to build out products and solutions within financial technology (fin-tech), blockchain, cloud services, and mobile solutions.

Barclays, Wells Fargo, BNP Paribas, and a handful of other large global banks have created incubators that invest and build new ventures, focused mostly on disruptive fin-tech startups that directly solve major pain points within banking. Companies build these programs to be at the forefront of banking technology and part of the tech ecosystem. If they can’t build or fund a venture, they can utilize this innovative network to be early adopters.

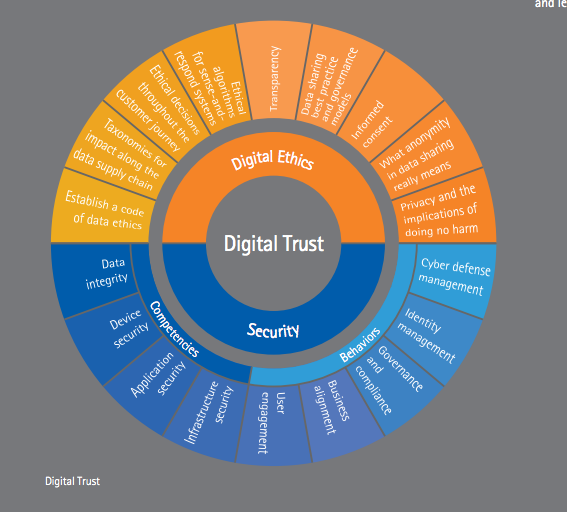

4. Digital Safety and Trust Will No Longer Be a Major Hurdle

Figure 2 Source: Accenture

As with any new technology dealing with personal finances, consumer banks experienced an early backlash to mobile and online banking. A 2015 survey on Statista showed that 72% of people currently not using mobile banking cited security concerns as one of the reasons why. Fast forward one short year later and third-party P2P payment processors, such as Venmo and Paypal, have become more prominent than bank transfers.

In 2016, Venmo processed over $20 billion in payments through its mobile only application. This implies that people are not only becoming more assured by linking their bank information to payment processors, many do so with third-party apps that offer limited user protection.

For banks, trust and user protection rank as a top priority, with 84% of bank executives citing trust as the cornerstone of the digital economy in banking. By using a combination of cutting-edge banking technology for data protection, communication and ethics, and risk management, banks are starting to convert more and more customers in the digital economy.

5. Blockchain Will Combine All of the Above to Rise in Prominence

Blockchain technology is reinventing digital security and trust by chaining together data and transactions within a distributed database that can’t be modified. In layman’s terms, this means that information can be shared but not changed. Blockchain's reliable track record could solve many compliance and security issues currently facing banks.

Also, Blockchain is completely transparent and can’t be corrupted. While still in its infancy, blockchain technology has reclaimed popularity after its initial exposure during the early bitcoin days. Banks are currently scrambling to find a way to incorporate blockchain technology. The excess of sensitive information that banks deal with makes it difficult to incorporate.

How are financial institutions onboarding employees in a time of increasingly complex compliance and regulation?

How are financial institutions onboarding employees in a time of increasingly complex compliance and regulation?

What's technology's impact and how are companies already using it?

- State of the industry's technology

- Banks & mobile apps: can they benefit?

- Onboarding and innovation in banking

- Onboarding implementations

- 10 facts on retention, training, and talent sourcing

- Exclusive TLDR summary

.jpg)

.jpg)

.jpg)