The US automotive industry is fresh off of a record breaking sales year in 2016, with over 17.5 million cars sold. Globally, the auto industry is experiencing its largest growth in developing and emerging economies. Car buying behaviors impact auto industry trends. Growing access to credit and disposable income are allowing consumers to explore first-time car purchases.

-1.jpg?width=1200&name=1200x627-1%20(4)-1.jpg)

McKinsey and Co. reports that emerging markets’ share of global auto sales will rise from 50 percent in 2012 to 60 percent by 2020. In 2016, worldwide automotive sales reached a record 88 million cars sold, up 4.8% from 2015.

Behind the scenes, a technological movement stemming from large R&D budgets and innovative initiatives by some of the world’s largest companies is powering a connected and autonomous car phenomenon that will inevitably change the world.

It is important to note that this initiative is largely rooted in developed economies, with many emerging markets still very dependent on traditional automotive transportation. With that being said, a competitive race to design and develop autonomous vehicles is currently occurring with all major car manufacturers – resulting in new and revolutionary automotive industry trends.

5 Technological Automotive Industry Trends to Watch

1. Rise in Strategic Partnerships with External Tech Companies

Automotive companies and original equipment manufactures (OEMs) have traditionally been extremely involved in building the innovative features demanded by their customers. Due to high-tech players, such as Google and Uber entering the space, manufacturers have and will continue to forge external partnerships to expedite software and products that they can integrate into their product roadmap.

Beyond manufactures, investors and high-tech firms are aggressively attacking the industry. TechCrunch reported that from 2011-2016, M&A transactions in the automotive space totaled over $220 billion.

A Snapshot of Recent Investments and Future Milestones in Auto-Tech

- March 2016: General Motors Co. bought self-driving software startup Cruise Automation and invested $500 million in car-sharing app, Lyft

- May 2016: Google partnered with Fiat Chrysler to test self-drive technology

- June 2016: Google invested $100 million in two flying car startups

- January 2017: Nvidia goes public with self-driving trucks being a point of discussion

- February 2017: Ford invested $1 billion in an autonomous vehicle tech firm

- April 2017: Apple announced they will be testing self-driving car technology

- April 2017: Sources stated Amazon hired a team to explore deliver via autonomous vehicles

This brief snapshot is a small fraction of the investments and deals made within the auto-tech industry and illustrates just how important auto disruption is becoming. Expect to see more M&A transactions as companies consolidate resources to gain competitive advantages.

2. Connected and Autonomous Vehicles Are Gaining Rapid Momentum

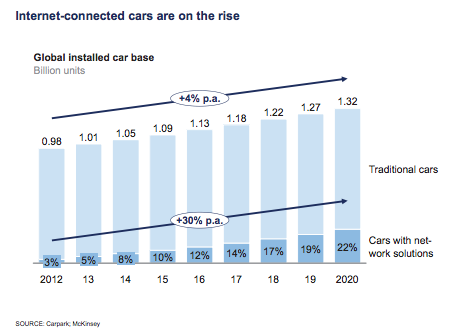

Autonomous and connected vehicles are at the core of all of these trends. It is estimated that 10 million self-driving cars will be on the streets by 2020 and the number of networked cars will rise 30 percent a year for the next several years; by 2020, one in five cars will be connected to the Internet.

These cars will be in the premium segment (approximately 50 percent) and increasingly in the value segment as well, where many of them will have network solutions by 2020 (compared to 3 percent in 2011). The autonomous car movement is being fueled by both ends of the spectrum, as consumer demand for eco-friendly cars with connected features increases.

The next level to this movement is the fully autonomous vehicle becoming the predominant means of transport and travel for the masses. Experts predict this will happen by 2030.

3. Increased R&D Spending on Par with the World’s Most Innovative Companies

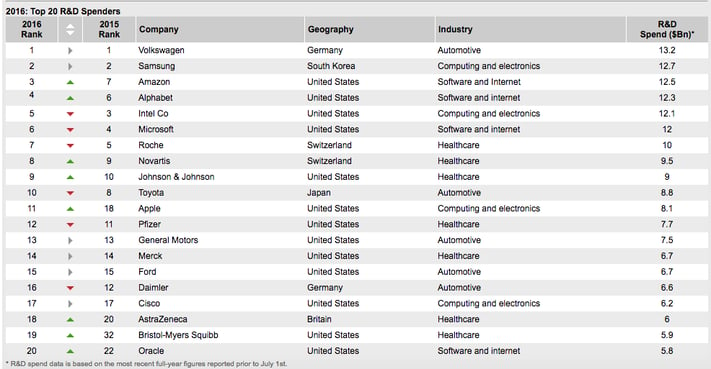

Across industries, innovation is largely measured by the amount of R&D resources allocated to drive innovative products and features. Given the future roadmap of automotive innovation, which largely overlaps with the tech industry, it should be of no surprise that R&D figures correlate with this trend.

A quick look at the top 20 R&D spenders in 2016 reveals that 13 out of 20 of the largest R&D spenders are in the automotive, computing, and or software industries. Automotive companies alone accounted for 4 of the placements, making it the third highest spender on R&D. A study completed by PwC found that companies that spend more on R&D achieve faster revenue growth than companies that don’t.

Despite increased R&D spending, it is important to note that automakers will not be able to fulfill every component, particularly software, in their production process. Partnerships, investments into tech companies, and M&A will still play an important factor moving forward.

4. Shift in Hiring Needs: Engineers and Computer Scientists Lead the Way

Software is at the core of automotive industry trends. It helps power processors that act as the mind of a smart vehicle by helping to control sensors, GPS radars, and other safety mechanisms.

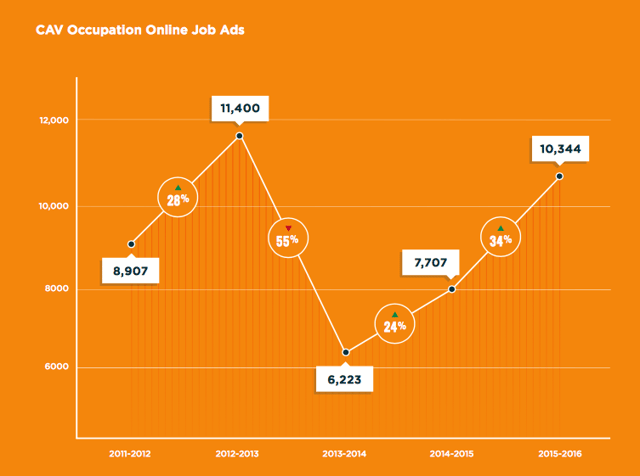

A study released in 2017 by the Workforce Intelligence Network describes how automotive industry trends are causing a large shortage of qualified autonomous vehicle workers. According to the study, current automotive employees are learning new skills and future workers will be asked to apply a “specific skill set to CAV projects as the product cycle for this disruptive technology matures.”

This graph shows the increase of connected autonomous vehicle job postings, rising 34% from 2015 to 2016. The profile needed by most AV companies is the same profile that fits into IT, cybersecurity, civil and mechanical engineering, system design, and other technical industries. Expect to see more specialized training and solutions being adapted by automotive companies to fulfill this need.

5. Consumers Increasingly Browse Online and Demand Digital Solutions

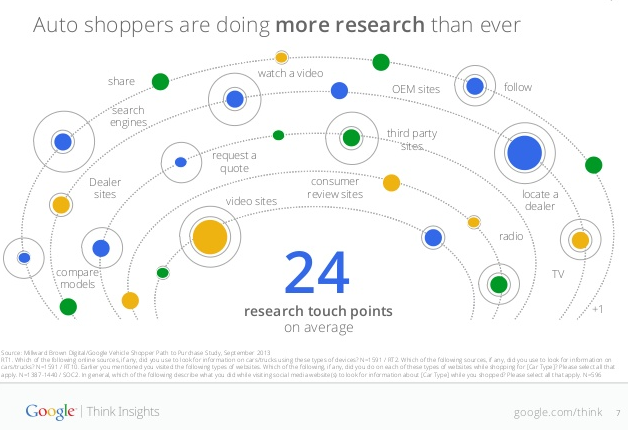

A 2016 survey released by CDK Global found that 90% of car shoppers would prefer beginning the buying process online, rather than in-store. In fact, McKinsey and Co. found that digital channels are already the primary information source for customers looking to buy a vehicle. The dealership of the past will need to adapt to accommodate new requests and abide by state laws which can hinder the process.

The fact is that the average car consumer today is much more educated and well-versed in the buying process, researching an average 24 touch points before making a purchase:

Carvana, an auto-tech startup that recently went public, has already released automotive vending machines in the United States. This model eliminates the need for dealing with sales staff and is one step closer to eliminating the dealership model all together.

The industry will continue to evolve into innovative digital and unconventional sales models in the future, especially as autonomous vehicles become widespread. Expect to see many changes, most focused on distribution channels, features, and manufacturing processes that will help deliver the best automotive technology to consumers at a fair price point.

-

Is automotive technology important for end consu

-

mers?

-

Balancing consumer demand & competitive advantages

-

Autonomous vehicles

-

Future of automotive product launches

-

Preparing for the future

-

Exclusive TLDR summary

.jpg)

.jpg)